UK Supply Chain Crisis: Why Pallet Prices Are at a Premium

- Published:

Reading Time: 7 minutes

Share this article

On October 12, 2021 by Josh Arrowsmith

Explore more: Experiences & Industry Insights | Case Studies | Testimonials

Demand for warehousing space in the UK is at an all-time high, and it is causing considerable disruption to operating and storage costs. The strains on the UK’s supply chain and warehousing are coming from every direction, with the COVID-19 pandemic acting as a catalyst in accelerating existing underlying issues.

While we can’t alleviate all the issues, we can at least explain how the UK finds itself in this situation, and what we at Finishing Line are doing to try to help our customers.

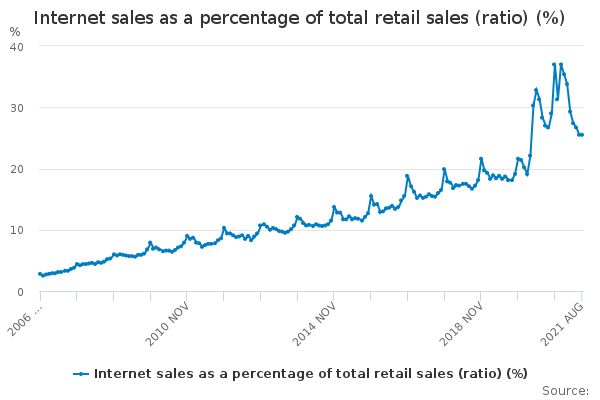

The Opinions and Lifestyle Study surveyed 1800 adults in 2020 and found that 87% of households had made online purchases in that year. Compare this to 2008, when just over half of all households had shopped online. With 84% of UK adults now owning a smartphone, it’s not surprising that online shopping has taken hold so significantly, but 2020 has shown the biggest year-on-year increase. And with COVID lockdowns, it’s quite possible that 2021 will show continued growth as the graph below captures the impact of the pandemic, and the potential changes in consumer habit that has been created.

Along with brands favouring the benefits of operating a digital retail model as opposed to having a physical store, there were also a number of major high street names placed into administration in recent years – TopShop, British Home Stores, Victoria’s Secret, and Debenhams to name a few. Many of these brands, however, have been acquired by online retailers, or retained their online presence, driving yet more online shopping traffic.

So there was a significant increase is online shopping, and that doesn’t look to be declining yet. Therefore, we’re seeing growth in not only the number of e-retailers but also the number of lines they are offering. The aforementioned has meant that there is more of a demand for warehousing space to store stock for online stores, which is ultimately increasing the price of pallets.

According to research by Savills, one of the world’s leading property agents, in the UK in 2021 there are nearly 2,000 individual units for storage and distribution, accounting for almost 566m sq. ft. of warehouse space. This is a 32% increase from Savills’ previous report six years ago.

But it still isn’t enough to meet the growing demand, as soon as warehousing plots become available they are being snapped up by the likes of Amazon.

There is a general acceptance that there is insufficient capacity, but there isn’t a clear strategy on how this can be overcome so it’s looking like this could continue to be a factor for some years ahead.

Compounding the issue with the lack of warehousing space is the lack of availability of haulage drivers.

With an ageing population of drivers, the restrictions on overseas drivers following Brexit, cancellations of driving tests, and the ‘pingdemic’, there has been what the Road Haulage Association describes as a ‘crippling shortage’ of HGV drivers. This has ultimately meant far fewer items being moved from A to B, resulting in stock is staying put in warehouses for longer before being collected, which is further fuelling demand for already limited pallet space.

In response, some companies are looking to store greater volumes of inventory to limit the frequency of re-stocks.

Delays in production and shipping caused by COVID-19 has also forced companies to abandon the preferred ‘Just in Time’ (JIT) supply chain model and in favour of the ‘stockpiling’ approach due to lack of guarantee that stock will arrive on time.

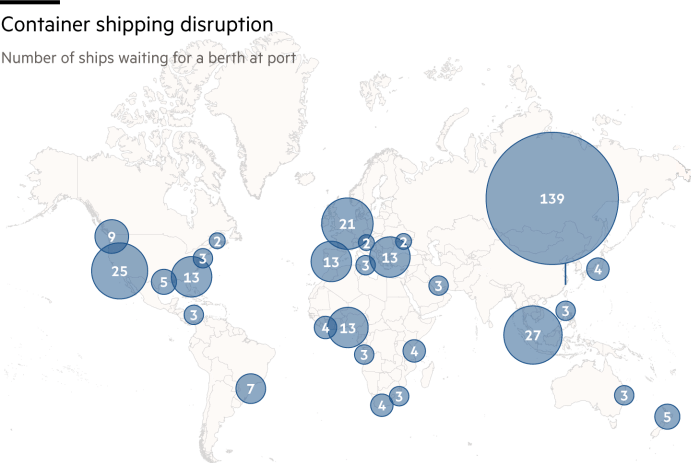

The aforementioned factors are directly contributing to serious congestion at UK ports, with major shipping companies having to rethink their shipping routes. Lars Mikael Jensen, head of the global ocean network at Maersk, the world’s largest shipping company, confirmed that the company has now decided to temporarily divert larger vessels away from Felixstowe (UK’s largest container port) due to the port’s capacity crisis and inability to discharge containers. Felixstowe is thought to be among the top two or three worst-hit terminals globally.

Felixstowe port said a shortage of drivers meant that it was taking about 10 days before cargo could be taken inland to be unloaded, up from the usual four-and-a-half days. It said the “situation was improving”, adding that it now had the most space for inbound containers since the beginning of July.

There are currently 353 container ships stuck outside ports around the world, more than double the number from earlier in the year, according to real-time data from logistics company Kuehne+Nagel.

An increase in the number of items being ordered, coupled with the existing shortage of container ships and increasing lead times for ship production, has fuelled the demand for container space. This has inevitably led to record-high container prices, shipping a container between China and Europe costs more than six times as much as a year ago.

Reduced domestic air travel has also played a part in preventing the movement of goods. Pre-pandemic it was very common for smaller items to piggyback on domestic flights by being stored in the hold. The grounding of many flights during the height of the pandemic forced these items onto alternative routes to their end destinations, such as land and sea, further increasing pressure on these already stretched options.

Yes, Brexit. With new rules, regulations, and requirements during the customs process, such as additional paperwork and duty payments, the previous free movement of items between the UK and Europe has been constrained.

These items require far more accompanying paperwork when passing through customs, resulting in a high percentage of items being held or returned. Again, this has resulted in a far greater number of items being stuck in storage.

As part of their initial response to Brexit, many organizations reviewed their existing supply chains to identify the implications and potential mitigations. It remains to be seen as having a long-term impact but it seems likely that there will be commercial changes to supply chains, such as setting up a presence in the UK or EU, opening additional warehouse locations, and changing the location of the importation of goods.

We appreciate that these are unprecedented times within the supply chain industry, which has had a dramatic effect on operating and storage costs. If you are looking to find either extra space or a partner that works with you to re-engineer your current storage capacity, please get in touch with us, send a live chat message, or call +44 (0)1268 498 950

Additionally, we have decades of experience in ecommerce fulfilment, returns management, contract packing and warehouse management, and will advise on how to optimise your warehouse space.

Be sure to sign up for our email list, and keep updated with more of our revolutionary industry insights.

Send us your direct enquiry via email:

Was this article helpful? Share with your network below